CHOYU Equity Management will maintain and increase the accumulated social capital by investing so that future generations benefit in living more robust lives.

Under the postwar Showa era economic development, Japan achieved national reconstruction and social capital accumulation at an astonishing speed. In the Heisei era, we have maintained the leading position in the world with the accumulated assets and value. We now face new situation and we must proactively change our activities.

Under these circumstances, we will proceed with our investment business with the following three principles in mind.

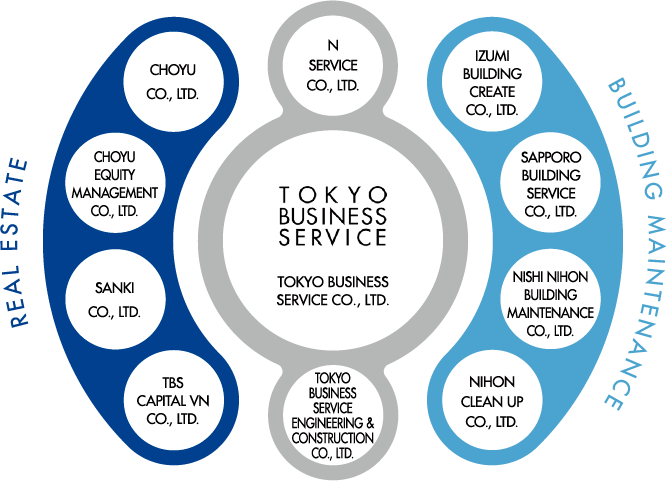

In the N Service Group's real estate business, CHOYU Equity Management Co., Ltd. will utilize the experience gained in domestic and international real estate investments and equity investments to handle asset management and investment business , leveraging the group's overall strength.

With your support and cooperation, we aim to be a company that contributes to creating a prosperous Japan. Thank you for your continued support.

President Koki Seki

We, CHOYU Equity Management Co., Ltd,

Based on the social capital accumulated by our predecessors,

With the proactive approach of investment,

Create social infrastructure for the use of the next generation.

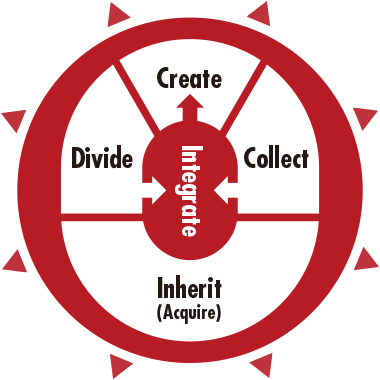

Capitalizing on the acquired assets, CEM shall create new value by diversification and concentration which may appear contradicting each other.

On top of the real estate assets already owned, CEM shall acquire new assets and collect external funds as well as liquidating some of the existing assets. Through these activities, CEM intends to expand the scope of the mission beyond giving sufficient returns to each investor, and to reach the level of creating value to the society at large.

We will carefully review the changes in the society at large and analyze the situation with critical review of structural changes. By so doing, CEM will achieve the success and create new value.

CEM inherits and properly maintains assets accumulated in the past. CEM adds value to the assets.

CEM utilizes the know-how cultivated building maintenance business and adds value by optimizing equipment specifications and applications.

CEM participates in the renewable energy business, including the emission rights business and RE100 initiatives. We intend to go beyond the framework of the FIT system.

CEM participates in the sustainable ecology efforts and promotes to nurture the precious assets of human beings.

CEM intends to create value by investing in the new and promising fields.

CEM aggressively innovates the business model based on in depth structural analysis of risks and returns and on our own cash flow analysis, which is beyond the conventional methodology.

CEM collects dispersed assets, which are often under-utilized and adds value by dividing the collected assets.

Through this process CEM tries to change the world by addressing issues that cannot be solved by a single client company.

We CEM will play a role in the change efforts.

Collecting project information from inside and outside the TBS Group, CEM conducts structural analysis of risks and returns and evaluates the investment opportunities.

In executing an investment CEM selects one of the affiliate companies in TBS group as the project manager.

・Building maintenance

・Business support

SANKI Co., Ltd.

SANKI Co., Ltd.

■Real estate development business

・Condominium apartment

・Apartment

・Terraced House

[Home land building business]

Tokyo Metropolitan Governor

License (3) No. 087226

[General construction industry license]

Tokyo Metropolitan Government (General-27)

No. 144745

TBS Capital Vietnam

Co., Ltd.

TBS Capital Vietnam

Co., Ltd.

■Overseas Real Estate Investment

■Overseas finance business

Choyu Equity Management

Co., Ltd.

Choyu Equity

Management

Co., Ltd.

■Investment business

・Fund investment

・Business investment

・Real estate investment

(domestic / overseas)

・M & A

[Home land building business]

Tokyo Metropolitan Governor

License (1) No. 102036

[Financial instruments business]

Director-General of the Kanto Local Finance Bureau

License No. 3325

Choyu Co., Ltd.

Choyu Co., Ltd.

■Building management business

■Profitable real estate investment business

[Type Ⅱ Financial Instruments Business]

Investment advice and agency business

Director-general of Kanto Local Finance Bureau (Kinsho) No. 2259

[Home land building business]

Tokyo Metropolitan Governor License (4) No.080762

[Condominium apartment management]

Minister of Land, Infrastructure and Transport License (4) No. 030904

Tokyo Business Service

Co., Ltd.

・Building maintenance

・Business support

SANKI Co., Ltd.

■Real estate development business

・Condominium apartment

・Apartment

・Terraced House

[Home land building business]

Tokyo Metropolitan Governor License (3) No. 087226

[General construction industry license]

Tokyo Metropolitan Government (General-27) No. 144745

TBS Capital Vietnam Co., Ltd.

■Overseas Real Estate Investment

■Overseas finance business

Choyu Equity Management

Co., Ltd.

■Investment business

・Fund investment

・Business investment

・Real estate investment

(domestic / overseas)

・M & A

[Home land building business]

Tokyo Metropolitan Governor License (1) No. 102036

[Financial instruments business]

irector-General of the Kanto Local Finance Bureau License No. 3325

Choyu Co., Ltd.

■Building management business

■Profitable real estate investment business

[Type Ⅱ Financial Instruments Business]

Investment advice and agency business

Director-general of Kanto Local Finance Bureau (Kinsho) No. 2259

[Home land building business]

Tokyo Metropolitan Governor License (4) No.080762

[Condominium apartment management]

Minister of Land, Infrastructure and Transport License (4) No. 030904

| 2009 | Acquisition of the Kanda System Building Long-term investment / ¥ 3,000 million |

Acquisition of the Kanda System Building | Long-term investment | ¥ 3,000 million |

|---|---|---|---|---|

| 2012 | Equity investment in TOREIF fund (Sumitomo Mitsui Trust Bank, Limited and Axa Life Insurance Co., Ltd.) Short-term investment / ¥ 700 million |

Equity investment in TOREIF fund (Sumitomo Mitsui Trust Bank, Limited and Axa Life Insurance Co., Ltd.) | Short-term investment | ¥ 700 million |

| 2013 | Set up private fund for acquisition of the Suehirocho office building Equity joint-investment with Sun Frontier Real Estate Renovation investment of used office / ¥ 250 million |

Set up private fund for acquisition of the Suehirocho office building Equity joint-investment with Sun Frontier Real Estate | Renovation investment of used office |

¥ 250 million |

| Acquisition of the DK Kawasaki Building Long-term investment / ¥ 1,000 million |

Acquisition of the DK Kawasaki Building | Long-term investment | ¥ 1,000 million | |

| 2016 | Investment in bridge fund (Kawasaki Solid Square) organized by Tokio Marine Asset Management Co., Ltd. Short-term investment / ¥ 500 million |

Investment in bridge fund (Kawasaki Solid Square) organized by Tokio Marine Asset Management Co., Ltd. |

Short-term investment | ¥ 500 million |

| Joint project of Heiwadai condominium apartment development (One selling) with Sanki Co., Ltd. Short-term development type investment / ¥ 610 million |

Joint project of Heiwadai condominium apartment development (One selling) with Sanki Co., Ltd. | Short-term development type investment | ¥ 610 million | |

| 2017 | Investment in bridge fund (Nihon urban development project corporation) organized by Mizuho Securities Co., Ltd Medium-term investment / ¥ 100 million |

Investment in bridge fund (Nihon urban development project corporation) organized by Mizuho Securities Co., Ltd. | Medium-term investment | ¥ 100 million |

| Condominium apartment investment in Vietnam (Ho Chi Minh City) Long-term investment / ¥ 40 million |

Condominium apartment investment in Vietnam (Ho Chi Minh City) | Long-term investment | ¥ 40 million | |

| 2018 | Investment in bridge fund (Shinjuku Kimuraya Building) organized by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Short-term investment / ¥ 500 million |

Investment in bridge fund (Shinjuku Kimuraya Building) organized by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. | Short-term investment | ¥ 500 million |

| Joint project of Nishi Kamata condominium apartment development (One selling) with Sanki Co., Ltd. Short-term development type investment / ¥ 1,000 million |

Joint project of Nishi Kamata condominium apartment development (One selling) with Sanki Co., Ltd. | Short-term development type investment | ¥ 1,000 million | |

| Acquisition of Sanki Co., Ltd. Strategic MA investment / ¥ 1,000 million |

Acquisition of Sanki Co., Ltd. | Strategic MA investment | ¥ 1,000 million | |

| Investment in condominium apartment (Q7) in Vietnam (Ho Chi Minh City) Short-term investment / ¥ 30 million |

Investment in condominium apartment (Q7) in Vietnam (Ho Chi Minh City) |

Short-term investment | ¥ 30 million | |

| 2019 | Investment in serviced apartment in Vietnam (Vin Duong province) Long-term investment / ¥ 250 million |

Investment in serviced apartment in Vietnam (Vin Duong province) | Long-term investment | ¥ 250 million |

| Investment in housing development project (ANGIA BC27) in Vietnam (Ho Chi Minh City) Long-term development type investment / ¥ 350 million |

Investment in housing development project (ANGIA BC27) in Vietnam (Ho Chi Minh City) |

Long-term development type investment | ¥ 350 million | |

| Investment in bridge fund (Higashi Kanagawa commercial building) Long-term investment / ¥ 240 million |

Investment in bridge fund (Higashi Kanagawa commercial building) | Long-term investment | ¥ 240 million | |

| Investment in serviced apartment in Vietnam (Vin Duong province) Long-term investment / ¥ 208 million |

Investment in serviced apartment in Vietnam (Vin Duong province) | Long-term investment | ¥ 208 million | |

| Investment in serviced apartment in Vietnam (Hai Phong city) Long-term investment / ¥ 165 million |

Investment in serviced apartment in Vietnam (Hai Phong city) | Long-term investment | ¥ 165 million | |

| Investment in bridge fund (solar power generator) Short-term investment / ¥ 100 million |

Investment in bridge fund (solar power generator) | Short-term investment | ¥ 100 million | |

| Investment in solar power generator Long-term investment / ¥ 309 million |

Investment in solar power generator | Long-term investment | ¥ 309 million | |

| 2020 | Acquisition of a commercial building in FUJIMIGAOKA Long-term development type investment / ¥ 900 million |

Acquisition of a commercial building in FUJIMIGAOKA | Long-term development type investment | ¥ 900 million |

| Acquisition of an office building in OTSUKA Long-term development type investment / ¥ 140 million |

Acquisition of an office building in OTSUKA | Long-term development type investment | ¥ 140 million | |

| Investment in bridge fund (Solar power generator) Long-term investment / ¥ 1,000 million |

Investment in bridge fund (Solar power generator) | Long-term investment | ¥ 1,000 million | |

| 2021 | Investment in condominium apartment development project in Vietnam (Ho Chi Minh City) Long-term development type investment / ¥ 684 million |

Investment in condominium apartment development project in Vietnam (Ho Chi Minh City) | Long-term development type investment | ¥ 684 million |

| 2022 | Acquisition of an office building in YOTSUYA Long-term investment / ¥ 1,448 million |

Acquisition of an office building in YOTSUYA | Long-term investment | ¥1,448 million |

| Investment in bridge fund (apartment in OSAKA) Short-term investment / ¥ 500 million |

Investment in bridge fund (apartment in OSAKA) | Short-term investment | ¥ 500 million |

■Public Transportation

●5 minutes walk from Exit A5 of Tochomae Station on the Toei Oedo Line

●7 minutes walk from exit 2 of Nishi-Shinjuku Station on the Tokyo Metro Marunouchi Line

■Location

8th Floor Shinjyuku Green Tower Building

6-14-1, Nishishinjyuku, Shinjyuku-ku, Tokyo, 160-0023 Japan

TEL. +81-3-3348-6731